The sustainability movement attracts consumer attention worldwide.

Nearly 70% of millennials say they can’t afford to buy a traditional home.

Around 30% of Americans spend seven hours cleaning every week.

In the U.S., 40% of residents are minimalists or hope to become one.

What do all of these have in common, and more importantly, why should you care?

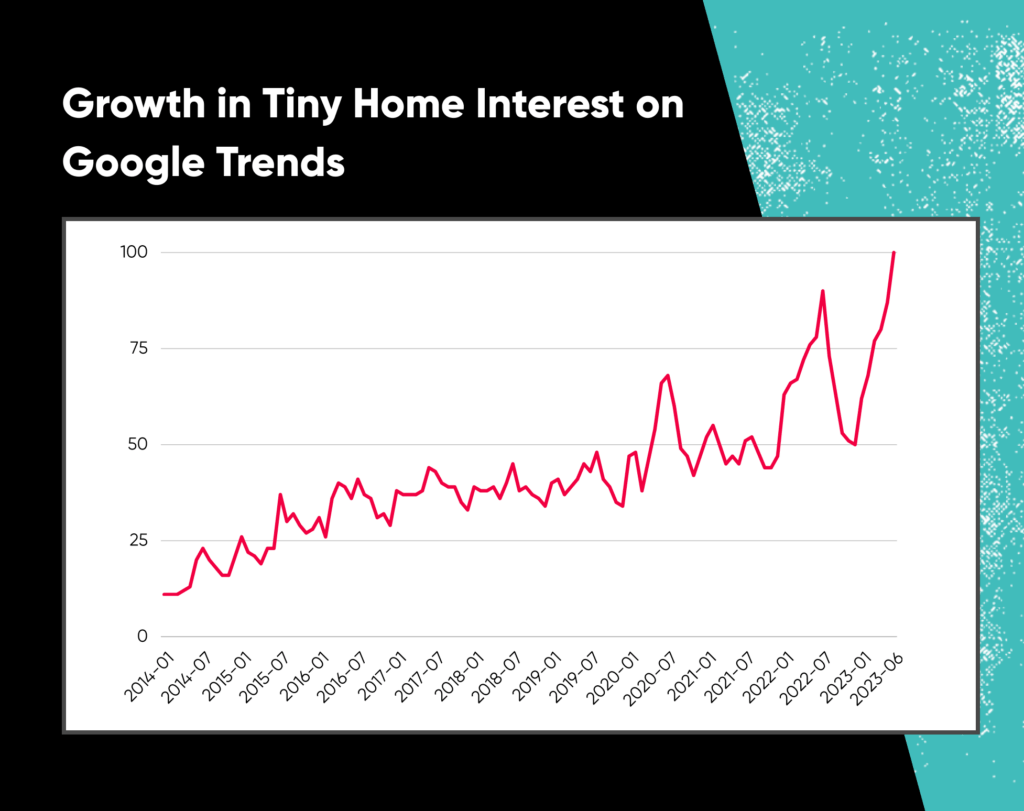

All of these stats are clues to some of the demand behind tiny homes. Culture is changing, and tiny homes are one way that people today release expectations and burdens while also reducing their carbon footprint.

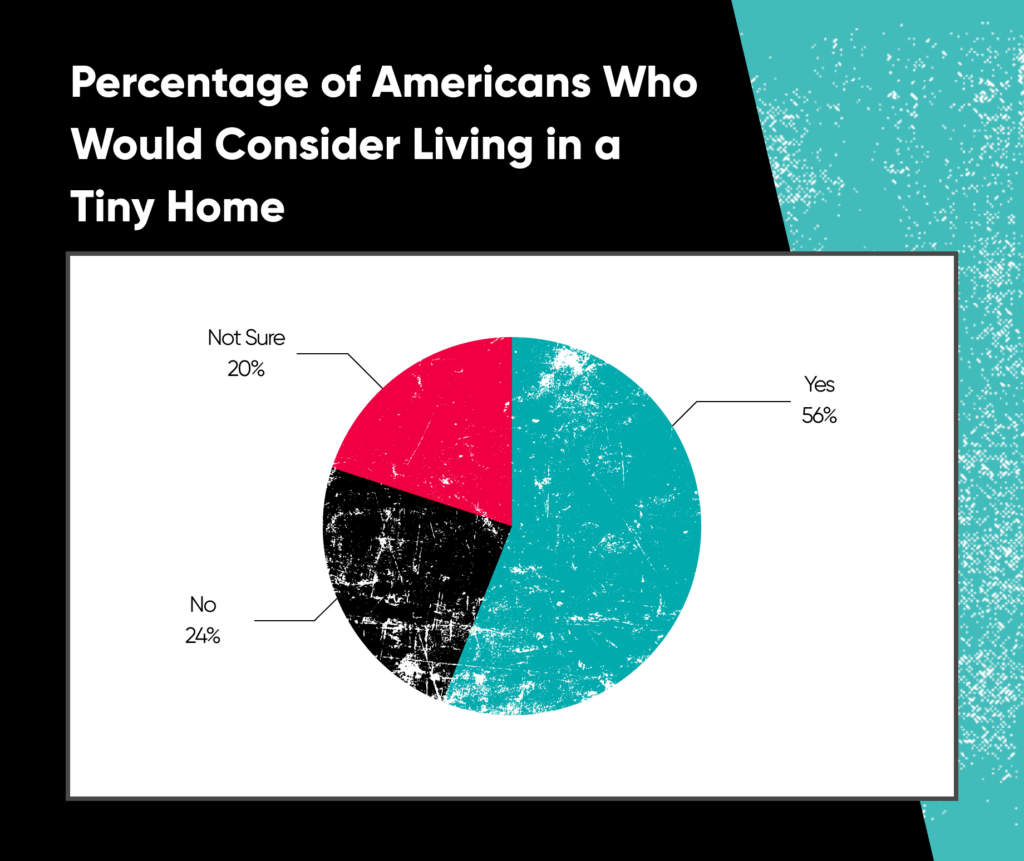

The average tiny home is between 100 and 400 square feet in size. One recent survey shows that more than half of people would be willing to live in a tiny home.

Capitalizing on tiny homes is not a passing fad. It’s a strategic investment move. Tiny homes are a sustainable investment opportunity with the potential for big returns as you rent them out.

There are 2 kinds of tiny homes:

- The kind on wheels, which are actually RVs.

- Tiny houses on foundations, AKA “accessory dwelling units.”

Building an ADU comes with more complex regulations, but a tiny house on wheels just needs state registration as an RV.

The Business Model of Tiny Home Investments

You can make money from your tiny home in a few ways:

- Building tiny homes to sell to other people.

- Building for long-term renters.

- Building for short-term rentals.

You can also purchase land and rent out the spaces to multiple owners of tiny homes on wheels. Technically, those are RVs, so you could even start an RV park!

Buying and setting up a tiny home or space for one is just the start.

You’ll also need to plan for maintenance, security, and marketing to renters.

Pro tip: if you plan to manage multiple tiny homes, consider a property manager if you prefer the hands-off approach.

Here’s a rundown of what you might earn for a short-term rental business with tiny homes:

Your average nightly rental rate depends on location and unique amenities but is typically between $40-100 per night. If you build a location with multiple tiny homes, you may be able to charge more for things like access to a pool area or laundry facility.

You may instead choose to focus on long-term rentals or running a build-to-sell company. But those come with big disadvantages:

- Long-term rentals open up typical legal issues related to landlord/tenant protections and licensing/permitting concerns for accessory dwelling units. That’s extra risk and red tape.

- If you build your own tiny homes on land and sell them, that’s a nice one-time deal but leaves you with no recurring revenue.

Things to Consider When Investing in Tiny Homes

Low-risk build costs + good nightly rate + high demand = cash money, right?

Hold your horses.

Take stock of the market demand for tiny homes and research legal issues and zoning laws. You’ll have the most issues with zoning for accessory dwelling unit tiny homes.

Your chosen location is key for getting bookings and protecting your investment if you decide to sell in the future, too.

Don’t forget about a few other important issues:

- You may need to install big-ticket items like electric or septic if you’re building a tiny home community.

- Tiny homes do still come with maintenance needs for each home and lawn care for the land around them.

- While tiny homes are popular, they are a limited market.

Even with those downsides in mind, investing in tiny homes is a viable way to generate revenue in today’s market.

How to Get Started with Investing in Tiny Homes

There are four steps to expanding your empire into the world of tiny homes:

- Find the right tiny home or place to build one

- Complete due diligence on your investment

- Get financing in order

- Market your rental

Finding the Right Tiny Home

Locate your tiny home in an area with peaceful and pleasant surrounding land and/or near a region with plenty of attractions.

You might look for a tiny home in one of a few ways:

- Looking for open land you could develop into a tiny home community

- Looking for existing tiny homes for sale to repurpose for your own business

- Seeking to build a tiny home and locate it on your own or some other property

Tiny homes really vary in cost. Most start around $30,000 and go up from there. An increasing number of manufacturers will also offer pre-built models for sale. (Check out Tumbleweed, Tiny Cocoons, and Wheelhaus for examples.)

Look for tiny homes in local real estate listings or on TinyHouseListings.com.

Due Diligence for Your Investment

Do some research before building tiny homes or setting up your own community for short or long-term rentals.

Here are some things to factor in with your decision:

- Is the location for any non-wheeled tiny home appealing? (Much like campgrounds and RV parks, try to find somewhere with natural appeal or close proximity to an attraction.)

- What are the local laws about parking tiny homes or adding them to land?

- Are there buyers/renters interested in tiny homes in this region? (Check out bookings on Airbnb or nearby campgrounds)

If you’re not tied to a certain region, know that some states are friendlier towards ADU tiny homes.

Choosing the Right Financing Option

Depending on the kind of business you want to start with tiny homes, you have five financing choices:

- Cash or private lending

- Bank personal or business loans (such as SBA loans)

- Seller financing

- Tiny house builder loans (if you’re buying the home from them)

- RV loans

With cash and private lending, you may be able to get to a closing date faster. You might even get a better price overall for going this route.

However, it can be risky to tie up your cash assets in one deal. Compare and contrast the rate and payback options on a loan before you commit to a cash offer.

Business loans help minimize your risk, especially if you go the SBA route and get decent terms and payback periods.

Most traditional mortgages do not cover tiny homes.

In a seller-financed deal, you pay back the seller in installments over time. While this has more flexible terms, not every seller is willing to do it. Further, you need an existing site/tiny home from an active seller, too. If you’re purchasing and building on land, you’ll need to look at other finance options.

Some tiny house builders also provide loans with reduced starting rates and longer term lengths when compared with personal loans, but you might need 20% of the purchase price in hand.

Finally, if the Recreational Vehicle Industry Association certifies the tiny house, you might be able to get an RV loan for the home.

With all your financing options, weigh out how much work you’ll need to do to launch the business since every month that passes in the build phase costs potential revenue. A clear business plan aids in a timeline for construction, too.

Attracting Tenants and Renting Out Your Tiny Home

Don’t even waste your time building or buying a tiny home for business purposes if you’re not prepared to market. The number of searches for unique stays on Airbnb grew by a whopping 94% between 2019 and 2021.

List your home widely online. List on the usual suspects like Airbnb and VRBO, but don’t stop there. Expedia, Booking.com, HomeExchange, and even TinyHouseListings can also accept your rental listing.

To set your rental prices, scope out the competition. Look at tiny homes with similar amenities in comparable areas to get a gauge of what you can expect.

For those aspiring to own/rent multiple tiny homes, paid tools like PriceLabs and BeyondPricing are worth the expense.

When it comes to photos, this is one place your iPhone may not cut it.

As the demand for tiny homes grows, invest in sessions with a local photographer. Photos should sell the space and the experience of staying there.

Before listing your tiny home rental, step back and look at it from a guest’s perspective:

- Is the space welcoming?

- Have you provided clear instructions about where to find things and how to use items in the home?

- Have you made access to the home simple?

Building vs. Buying an Existing Tiny Home

Now that you know you want a tiny home, are you better off buying one or building one?

We’re going to answer like a lawyer: it depends.

| DIY Build | Professional build | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

Case Study: Making $550 Per Year on Tiny Homes with Airbnb

Get creative with your tiny home business ideas.

You can live in one and rent it out when you’re traveling.

You could build a small park of them and rent those out.

Tiny homes aren’t just on trend for the long-term buyer. They are very popular with travelers.

Check out how Isaac built a tiny home community with options like group events, family reunions, and corporate offsites to maximize his bookings.

Operating Costs and Tax Implications

Owners of tiny homes on wheels (RVs) don’t pay property taxes on these homes. They will, however, have to pay for places to park it. That might even entail real estate taxes, depending on the location.

Tiny homeowners face other ongoing costs, too, like:

- Water/electricity

- Internet

- Maintenance

- Moving costs, if applicable

If you buy a tiny home on wheels, you may pay sales tax on it upfront, depending on your state. Alaska, Delaware, Montana, New Hampshire, and Oregon don’t have sales tax, FYI.

If you live in a state with personal property taxes, you’ll need to pay those annually for your trailer or tiny home.

While that’s the bad news, don’t forget the other side of taxes: you can claim deductions.

Check out the mortgage interest tax deduction. Your mortgage interest is much less for a tiny home than a traditional property, so make sure your tax professional guides you through the standard deduction vs. itemized deductions decision process.

Shape the Future of Living by Investing in Tiny Homes

Tiny homes are a sustainable and innovative housing solution. Tiny homes are a strategic way to expand your real estate investments while capitalizing on one of the fastest-growing trends in vacationing and home ownership.

If you want recurring revenue from rental bookings, consider this your official sign to get started.